About Angel Rising

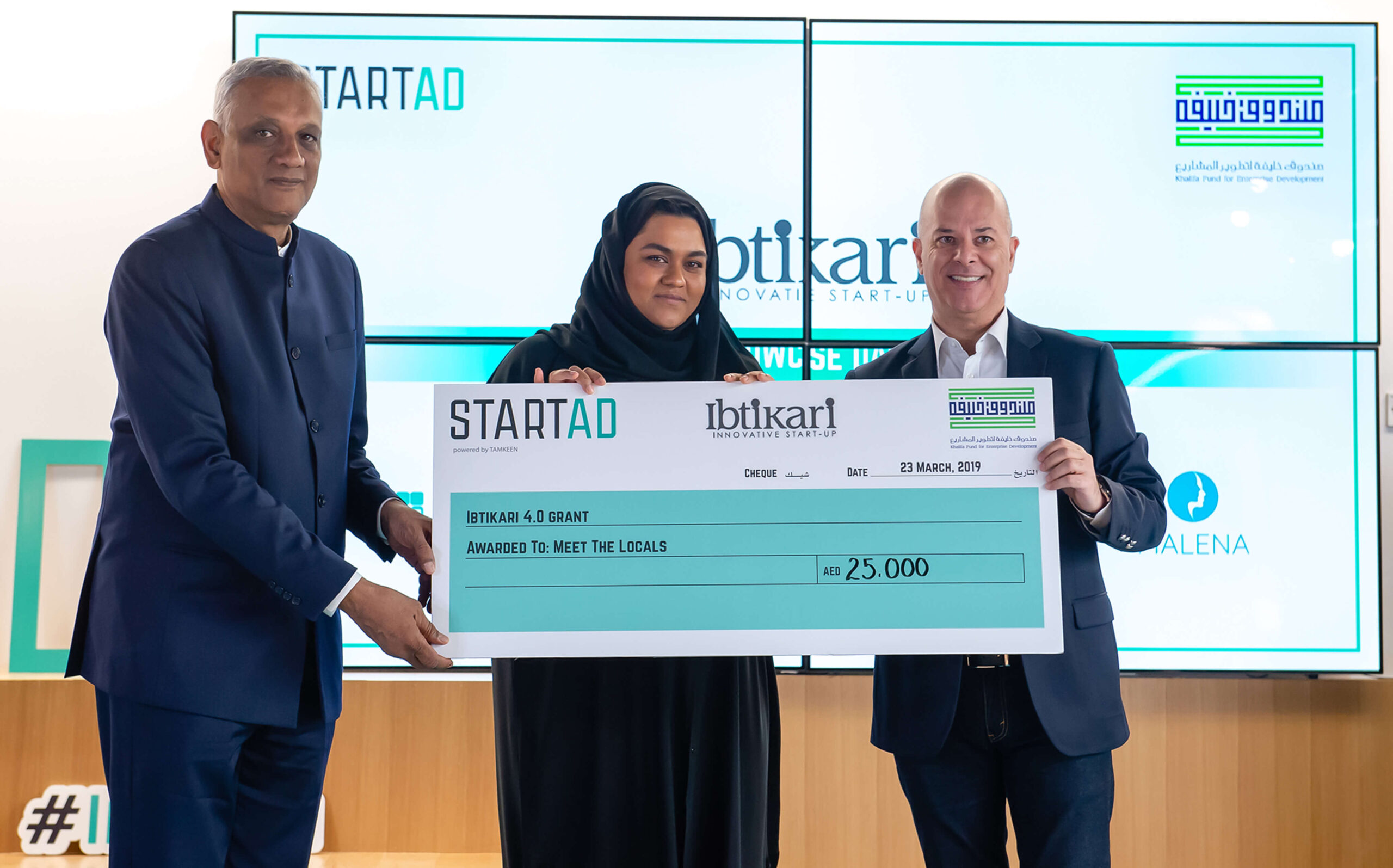

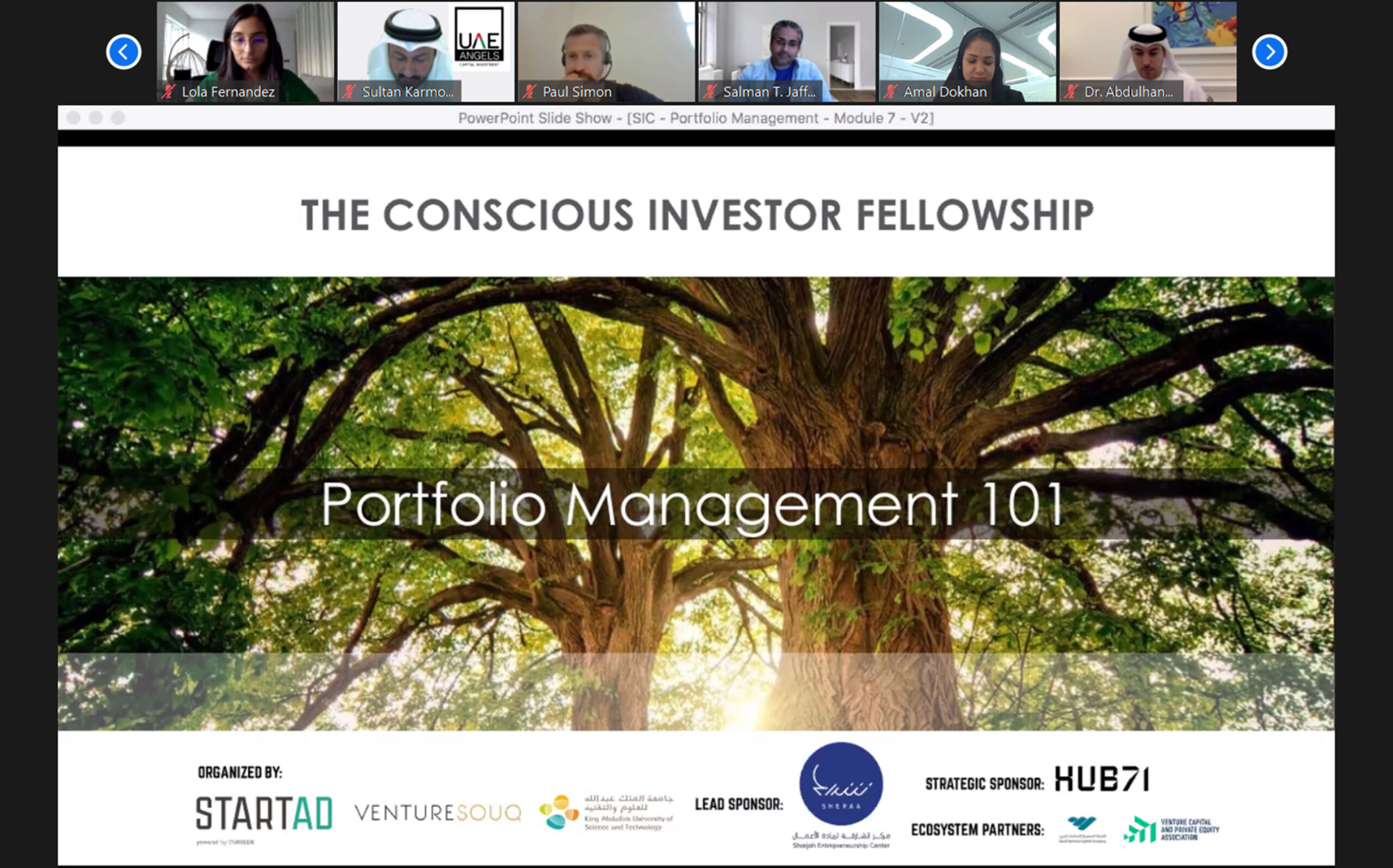

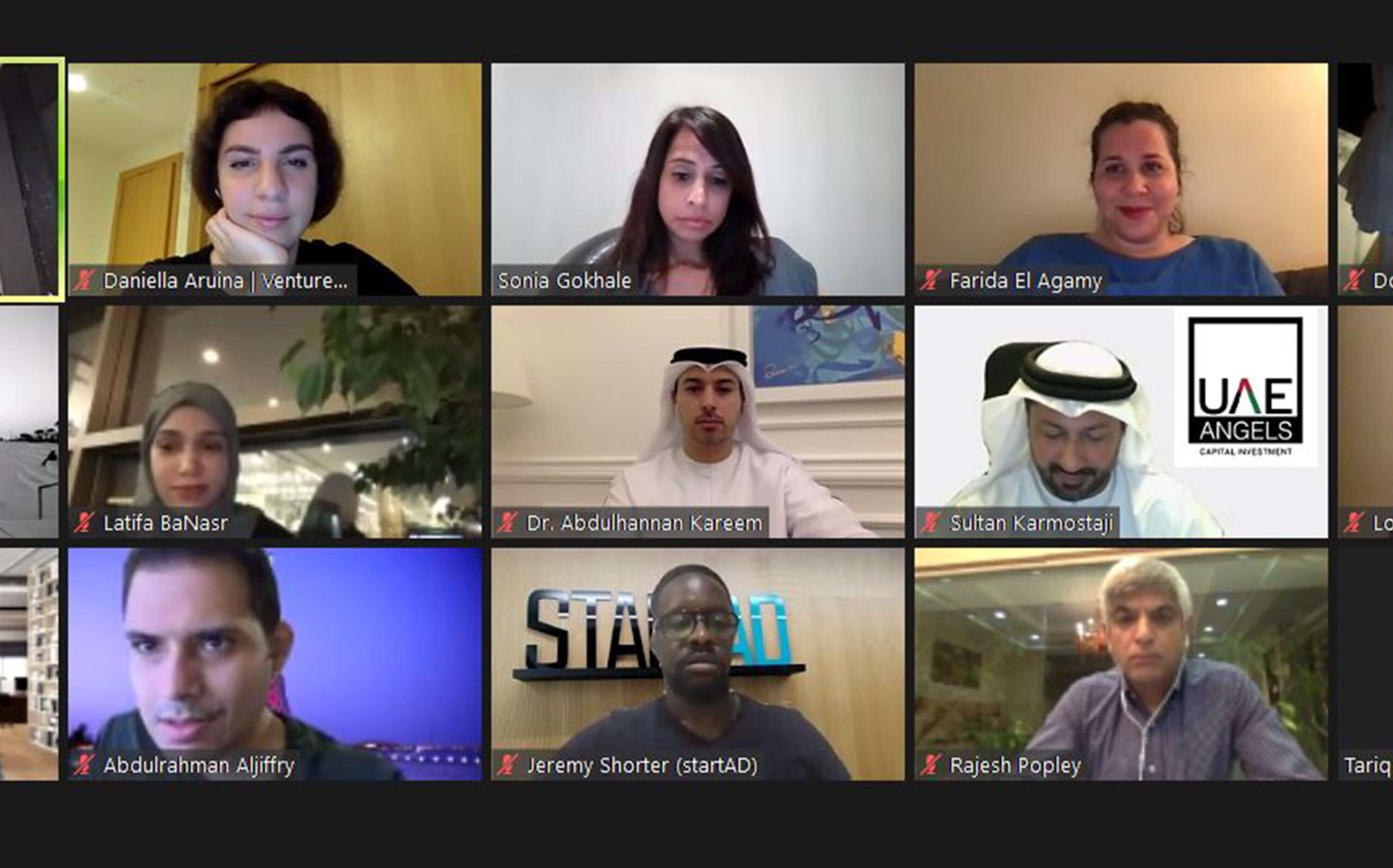

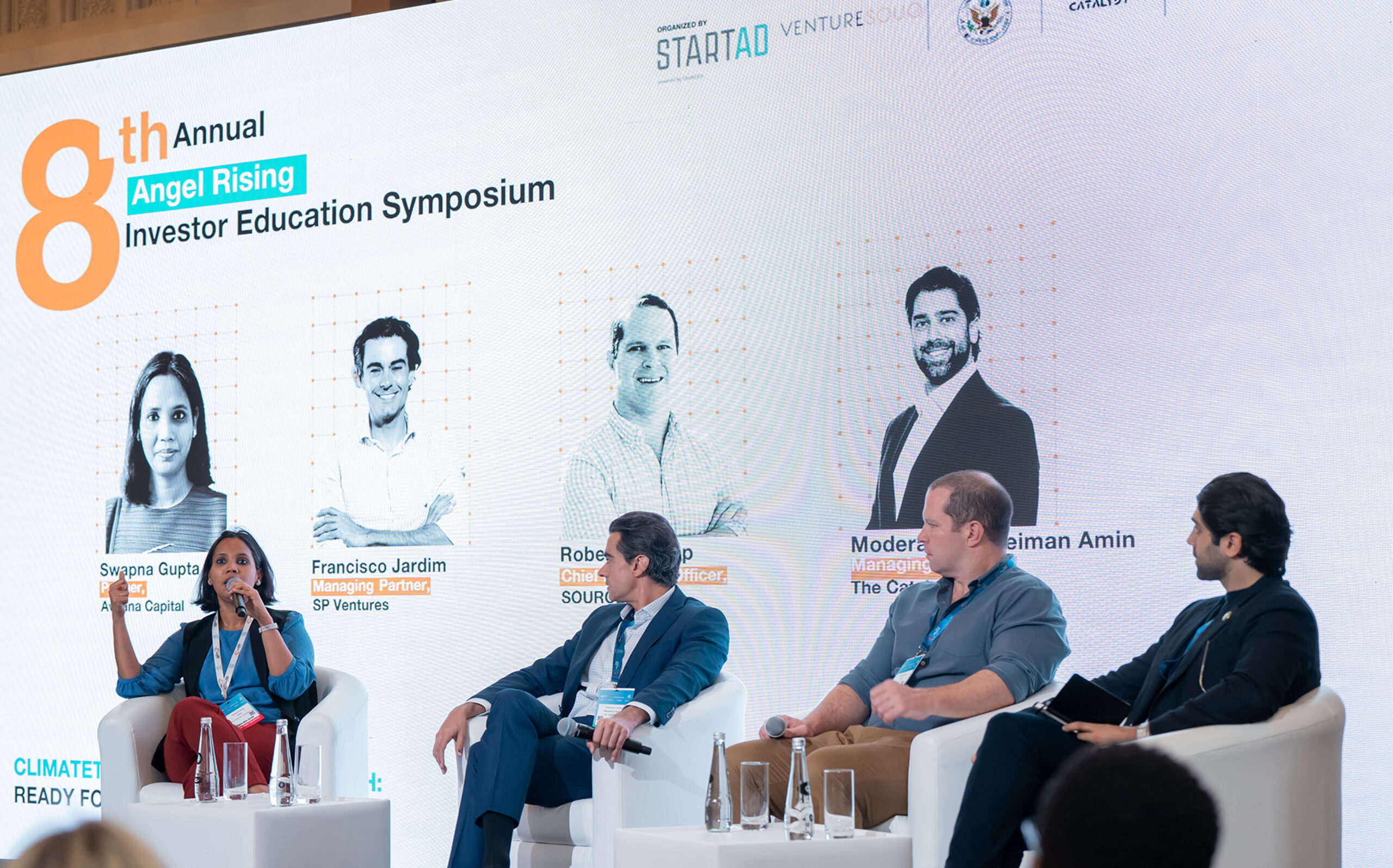

The Angel Rising Investor Education Symposium, co-hosted by startAD and VentureSouq with the Environment Agency – Abu Dhabi, is MENA’s flagship platform for investor education.

Since 2015, it has introduced regional investors to frontier themes like FoodTech, and Tech for Good. Now in its 9th edition, themed “Scaling Climate Resilience in the Global South,” Angel Rising will feature high-impact panels, firesides, and networking and bringing together global experts, regional investors, and policymakers to explore how capital can drive urgent climate solutions and strengthen MENA’s role in the global economy.