Just as the UAE has led the way globally in managing the Covid-19 pandemic, our government is equally keen to ensure that the economy swiftly rebounds and prospers in the months and years ahead. And it knows that SMEs are key to ensuring a bright future.

The AED30 billion package of financial support by the Emirates Development Bank Strategy for UAE’s SMEs and start-ups will provide support for businesses as they rebuild in the wake of coronavirus. It follows a string of recent measures to ensure to attract new start-ups and bolster existing SMEs.

Underscoring the importance of this sector, the federal government aims to increase the contribution of the SME sector to the national economy to around 60 percent this year, up from an estimated 54 percent in 2019. SMEs also contribute to 95 percent of the companies in the country and employ 86 percent of the total workforce in the non-oil private sector.

A nationwide project

Dubai has perhaps been perceived as having led the way in this regard, which is not surprising seeing as over 95 percent of its GDP is non-oil-based whereas in Abu Dhabi it is around 60 percent. However, 98 percent of all companies in Abu Dhabi are SMEs, contributing 29 percent of its GDP and 44 percent of its non-oil economy.

The drive to develop a diversified, knowledge economy is a nationwide priority and much has been done in Abu Dhabi to nurture SMEs and foster innovation. And this resolve has only strengthened with the onset of the pandemic.

For example, the Khalifa Fund for Enterprise Development (KFED), a leading funder for SMEs, last month partnered with Etihad Credit Insurance (ECI), the UAE Federal export credit company, to shore up the export capabilities of the country’s SMEs.

Last year saw the formation of the Advanced Technology Research Council (ATRC), which will expand and align the R&D ecosystem in Abu Dhabi. Its work will help reinforce Abu Dhabi and the UAE’s position as a global innovation hub.

In 2019, the Abu Dhabi government created an AED4 billion fund to boost research and development to increase business in the capital. The fund provides rebates on R&D spend and costs of new activities in Abu Dhabi, as part of the Abu Dhabi Development Accelerator Programme, Ghadan 21, launched at the start of 2019. Aside from this ongoing support, Ghadan 21 was behind the AED6 billion supply chain financing initiative, launched this January, to back SMEs in a variety of sectors.

And in February, startAD collaborated with Khalifa Fund to launch AI Mentor, a platform with a diverse range of digital tools and resources for entrepreneurs during the business planning phase. Powered by Tamkeen and anchored at NYU Abu Dhabi, startAD is a global accelerator that steers seed-stage technology start-ups to launch, develop, and scale their ventures. Over 7,000 participants have benefitted from our programs and graduated 124 global start-ups from 26 countries.

Platform for growth

To return to this week’s Emirates Development Bank (EDB) Strategy announcement, Dr Sultan Al Jaber, Minister of Industry and Advanced Technology, and chairman of EDB, said the strategy will help accelerate industrial development and the adoption of advanced technology through financing programs and investment funds to support entrepreneurs, start-ups and SMEs.

This move will have far reaching consequences. Firstly, it will support ‘Operation 300bn’, the government’s 10-year comprehensive strategy to increase the industrial sector’s contribution to GDP from AED133 billion to AED300 billion by 2031.

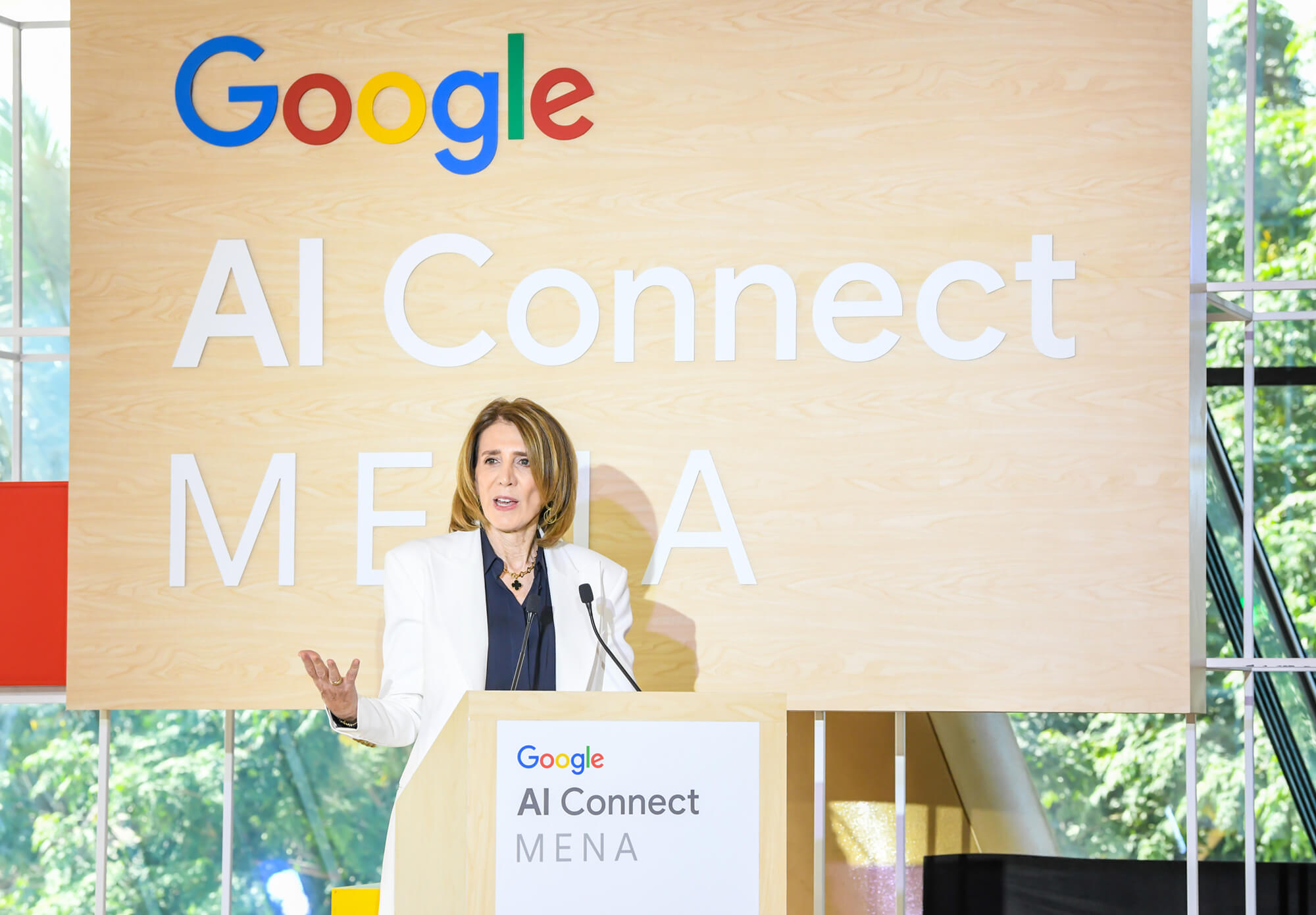

A large part of this contribution will come from technology-reliant future industries, where there is much potential for growth. For example, according to PwC, artificial intelligence alone will contribute up to 13.6 percent of the UAE’s GDP by 2030. Meanwhile, the Milken Institute predicts that MENA fintech start-ups will secure more than $2 billion in venture capital funding in 2022, compared to $80 million in 2017, a 25X increase.

These so-called ‘Fourth Industrial Revolution’ solutions, will be led by entrepreneurs and SMEs, creating an abundance of opportunities for our emirate and the nation. This will allow the SME sector to not only recover from the pandemic but thrive in the years to come, as we take advantage of historically unprecedented opportunities that are ripe for the taking.